- 10/15/2010

- Posted by: Mike O'Malley

- Category: air talent, coaching, country radio

National ratings data and lifestyle information on the major formats is again available for free in the newly released Radio Today 2010 pdf from Arbitron. Download it free here.

National ratings data and lifestyle information on the major formats is again available for free in the newly released Radio Today 2010 pdf from Arbitron. Download it free here.There’s lots of good news for country:

• Fall 2009’s combined (PPM and Diary) country share was 13.4% (4.4%/4th in PPM markets and 14.1%/1st in diary markets). That’s the highest share the format has delivered since spring 2002.

• Country radio’s reach is second only to AC.

• The format was number one in every daypart except mornings (#2 behind New/Talk/Information). It was also #1 25-34, 35-44 and 45-54. It was #2 18-24, 55-64 and 65+. 18-24 was the “growth demographic” and has been “up steadily in recent years.”

• 26% of the AQH audience is 18-34 and 42% is 18-44. 18-34s aren’t just cumers; their TSL of 6:30 is just under the 7:00 average 12+ and close to the 7:00 for 25-54 and 7:30 for 35-64.

Non-ratings information on the country audience includes education (half have attended or graduated college), earnings (half live in households earning $50,000 or more), home ownership (70%) and interests (country audiences index high on outdoor activities and slightly above the norm on texting).

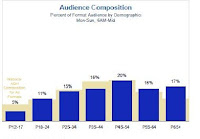

For programmers, one of the most useful pieces of data in any Arbitron report is the Audience Composition graph (the Radio 2010 AQH Composition for country is shown). Running graphs for cume and AQH give you a ‘big picture’ look at both plus the relationship between them.

For programmers, one of the most useful pieces of data in any Arbitron report is the Audience Composition graph (the Radio 2010 AQH Composition for country is shown). Running graphs for cume and AQH give you a ‘big picture’ look at both plus the relationship between them. An Audience Composition graph can also be a talent coaching tool, particularly if you’re concerned that a show isn’t as aligned with the audience as it should be. Compare a multi-book average of the station’s and the show’s Audience Composition. If there are undesirable differences, challenge the talent to cite the specific audience appeal for the show overall as well as its specific features and content pieces.

Comparing their perceived targets to the show’s Audience Composition might be what you need to offer congratulations or to shake things up a bit.