- 01/09/2019

- Posted by: Mike O'Malley

- Category: Uncategorized

Two years ago we started a new annual post: “Formats With the Most Momentum Going into the New Year.”

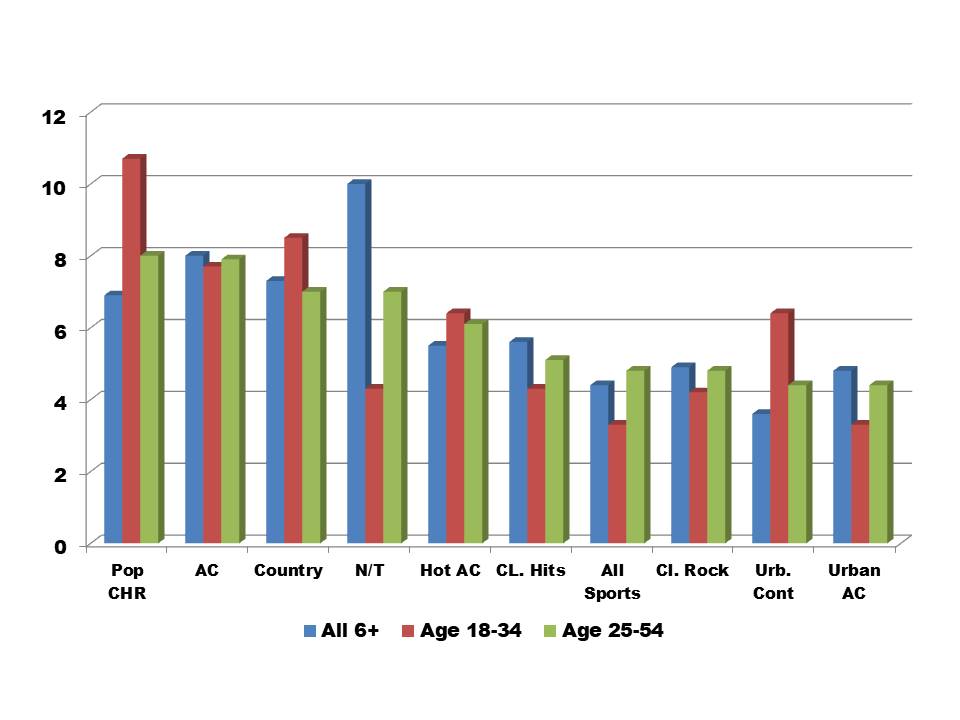

We use Nielsen’s Tops of 2018: Radio report for the data which looks at the 10 leading formats (shares) in PPM markets from January to November. They are broken out for 6+, 18-34 and 25-54. By trending this data, we have an idea of “Format Momentum” going into the New Year.

Here’s the overview as we start 2019:

The Big Picture

The bars are revealing in and of themselves. For example, it’s easy to pick out the 6+ leader (Blue Bar – News/Talk) and see how the NT total audience compares with 18-34 and 25-54. You can also see the strong 18-34 shares for Pop CHR and Urban Contemporary and the tight 25-54 race between CHR (8.0) and AC (7.9).

Country is in this mix as well.

Using a chart for each demo allows us to see things a little more clearly.

Formats With the Most Momentum Six-Plus

News-Talk was not only the 6+ share leader in 2018, it has been for each of the past five years. Over this time, N/T has had the largest share increase – a total of 1.2 shares.

Second for 2018 is AC which also has seen its 6+ share increase in each year since 2014.

Country was off slightly in 2018 with CHR seeing smaller shares as well while CHR is off the most since 2011, down 1.4 shares.

| 6+ | 2014 | 2015 | 2016 | 2017 | 2018 |

| N/T | 8.8 | 8.9 | 9.6 | 9.9 | 10.0 |

| AC | 7.1 | 7.4 | 7.5 | 7.7 | 8.0 |

| Country | 8.2 | 7.9 | 7.4 | 7.6 | 7.3 |

| CHR | 8.3 | 8.2 | 8.1 | 7.6 | 6.9 |

| Classic Hits | 5.2 | 5.3 | 5.3 | 5.3 | 5.6 |

| Hot AC | 6.2 | 6.7 | 6.4 | 5.9 | 5.5 |

| Classic Rock | 4.7 | 5.2 | 5.1 | 5.4 | 4.9 |

| Urban AC | 4.9 | 4.9 | 4.8 | 4.8 | 4.8 |

| Sports | 4.4 | 4.7 | 4.7 | 4.3 | 4.4 |

| Urban Contemp. | 3.5 | 3.7 | 3.8 | 3.6 | |

| Mex Regional | 3.7 | 3.7 |

Formats With the Most Momentum 18-34

Among 18-34s, CHR remains the top format with Country second. This 1-2 ranking has been unchanged since we first started tracking these results in 2013.

While both formats are off from 2014 – CHR 1.6 and Country 1.3 — Country did increase by 0.1 shares over last year while CHR fell 0.9 shares.

The largest increase among 18-34’s was in AC which is now up 1.8 shares since 2014.

Three formats that were among the Top 10 for the past several years were not present in 2018: Rhythmic CHR, Alternative and Mexican Regional.

| 18-34 | 2014 | 2015 | 2016 | 2017 | 2018 |

| CHR | 12.3 | 12.4 | 12.2 | 11.6 | 10.7 |

| Country | 9.8 | 9.1 | 8.6 | 8.4 | 8.5 |

| AC | 5.9 | 6.4 | 6.5 | 7.2 | 7.7 |

| Hot AC | 7.1 | 7.6 | 7.3 | 6.8 | 6.4 |

| Urban Contemp | 5.8 | 6.5 | 6.6 | 6.8 | 6.4 |

| NT | 3.5 | 3.6 | 4.1 | 4.4 | 4.3 |

| Classic Hits | 4.3 | ||||

| Classic Rock | 3.9 | 4.5 | 4.5 | 4.3 | 4.2 |

| Urban AC | 3.4 | ||||

| All Sports | 3.3 | ||||

| Rhythmic CHR | 6.7 | 5.8 | 5.1 | 5.1 | |

| Alt | 5.0 | 5.0 | 5.0 | 4.9 | |

| Mex Regional | 5.2 | 4.6 | 5.0 | 4.6 |

Formats With the Most Momentum 25-54

CHR is the top 25-54 format for the 6th consecutive year despite being off a full share since 2014. AC had the largest increase over the past five years to strengthen its hold on second place which it captured from Country in 2017.

Meanwhile, Country did improve its rank from 4th last year to 3(t) this year despite being off a share from 2015.

| 25-54 | 2014 | 2015 | 2016 | 2017 | 2018 |

| CHR | 9.0 | 9.0 | 8.8 | 8.5 | 8.0 |

| AC | 6.9 | 7.2 | 7.1 | 7.4 | 7.9 |

| NT | 6.2 | 6.2 | 6.9 | 7.4 | 7.0 |

| Country | 8.0 | 7.8 | 7.3 | 7.3 | 7.0 |

| Hot AC | 6.8 | 7.2 | 7.0 | 6.7 | 6.1 |

| Classic Rock | 5.3 | 5.7 | 5.4 | 5.5 | 4.8 |

| Classic Hits | 4.5 | 4.5 | 4.7 | 4.8 | 5.1 |

| Sports | 5.0 | 5.2 | 5.3 | 4.7 | 4.8 |

| Urban Contemp | 4.8 | 4.8 | 4.6 | 4.5 | 4.4 |

| Mex Regional | 4.6 | 4.1 | 4.5 | 4.5 | |

| Urban AC | 4.5 | 4.4 |

Share Compression

Looking at the share difference between the top ranked format and 10th ranked format in each age cell is also interesting and shows a how tightly clustered the Top 10 25-54 shares are compared to 6+ and 18-34.

| 6+ | 18-34 | 25-54 | |

| 2018 1st to 10th Share Differential | 6.4 | 7.4 | 3.6 |

The Music Format with the Most Momentum Going Into 2019

AC has delivered the greatest growth over the past five years among 6+ (+0.9), 18-34 (+1.8) and 25-54 (+1.0). Classic Hits is next up in 6+ (0.4) and 25-54 (0.6).

Year over year in 6+, AC and Classic Hits are each up 0.3 shares. Among 25-54s, AC is up 0.5 shares while Classic Hits is up 0.3.

In fact, AC and Classic Hits are the only two music formats to be up in both 6+ and 25-54.

AC was also up in 18-34.

Classic Hits was not among the Top 10 formats last year in 18-34, however AC was up 0.5 shares. The only other music format in the Top 10 to gain shares in this demo was Country which was up 8.4 – 8.5.

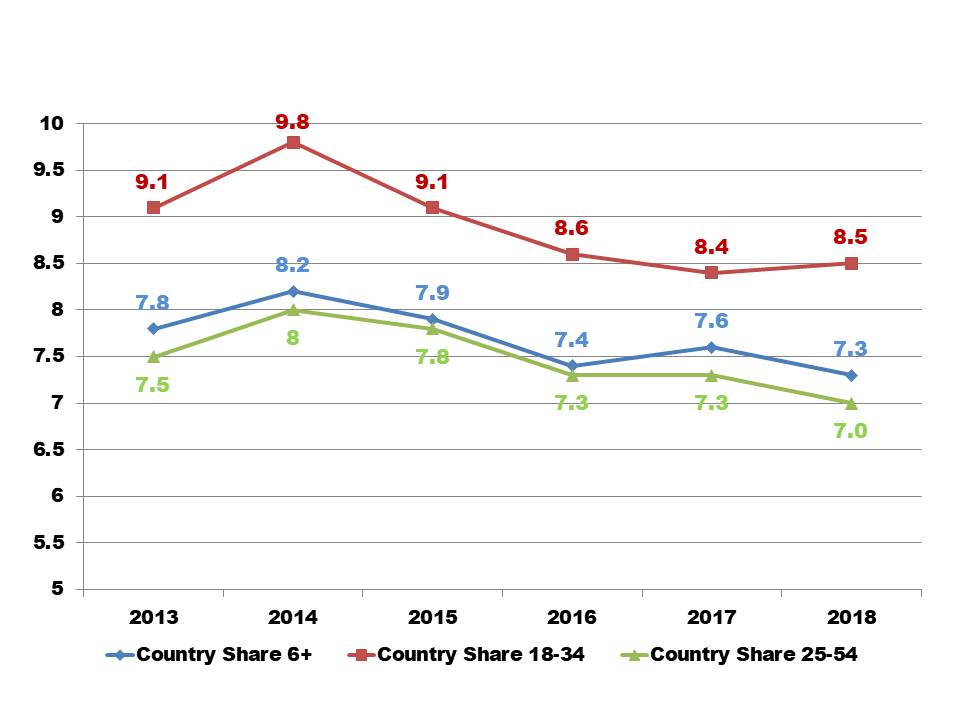

Country

Looking at the format by demo, Country’s 18-34 share had a slight uptick while 6+ and 25-54 were each off 0.3 shares.

While we don’t break out 18-24’s discretely in our year-end music tracking, we do know from Roadmap 2018 that this demo had the second highest percent saying Country music had “gotten better” over the previous 12 months.

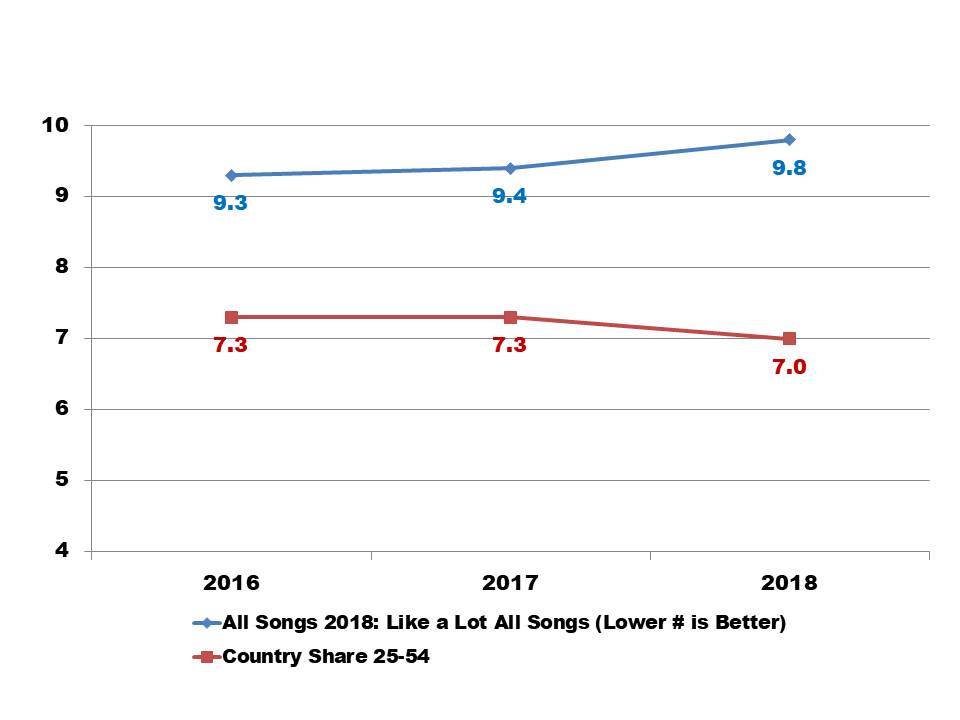

Meanwhile in the chart below, we did overlay Country’s 25-54 shares (higher is better) with the 25-54 year-end Like A Lot scores (lower is better) for the past three years. As the chart displays, this year’s weaker Like A Lot scores coincide with softer shares.

For Country, this is a reminder that managing music is imperative (there’s a detailed discussion about 2018’s music here).

Music aside however, helping your talent to be on top of their game – every day, every break – is also critical. We know from our years of Roadmap studies that talent is hugely important to Country listeners.

Format Leaders Can Help Us Discover Our Own Opportunities

Obviously every market is different, but trending what’s going on in your market – especially in the narrow demos of your overall target audience – can yield actionable information.

Over the next few months, commit to “hard monitors” of stations trending up. Listen for what could be helping to drive increases including talent, imaging, target focus, mic presence, uniqueness of sound, and more.

Competitive Monotoring

Competitive listening is best done outside of the radio station. Listen to both the OTA and the streaming product. Make plenty of notes especially of the things you hear (and don’t hear) that could present opportunities.

Review your notes with other programmers in your building who can offer additional insights.

Then immediately write up an action plan.

Competitive check-ups/reviews are hopefully something that you engage in throughout the year. If you haven’t been a regular at this, the beginning of a New Year is a great time to start a new habit.

And if you need a hand in developing your own competitive monitor system or strategy, just give us a shout.

Happy New Year! Let’s make 2019 awesome!

Related: